2022 tax brackets

There are seven federal income tax rates in 2023. Heres how they apply by filing status.

Tax Rates Tax Planning Solutions

Whether you are single a head of household married.

. 7 rows There are seven federal tax brackets for the 2021 tax year. 10 12 22 24 32 35 and. Heres a breakdown of last years.

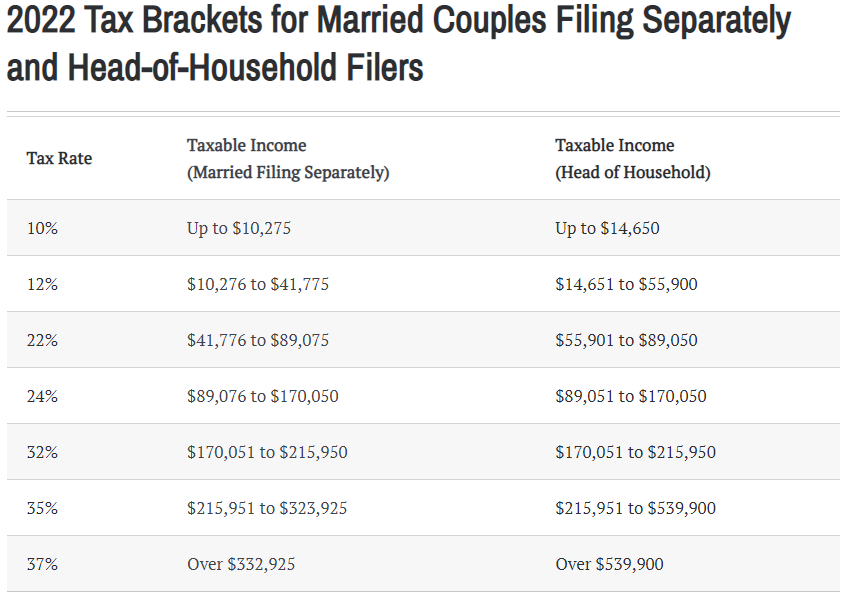

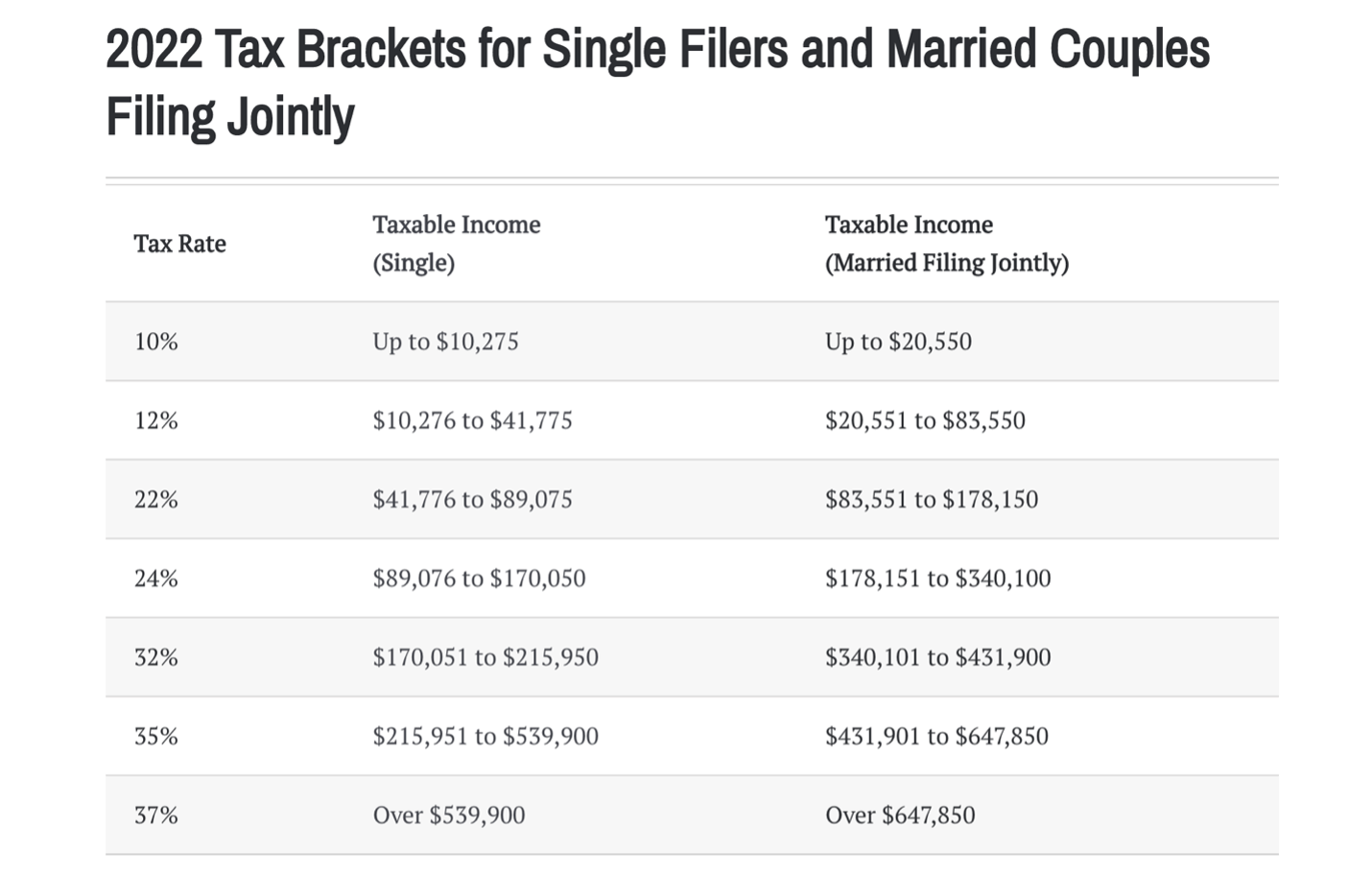

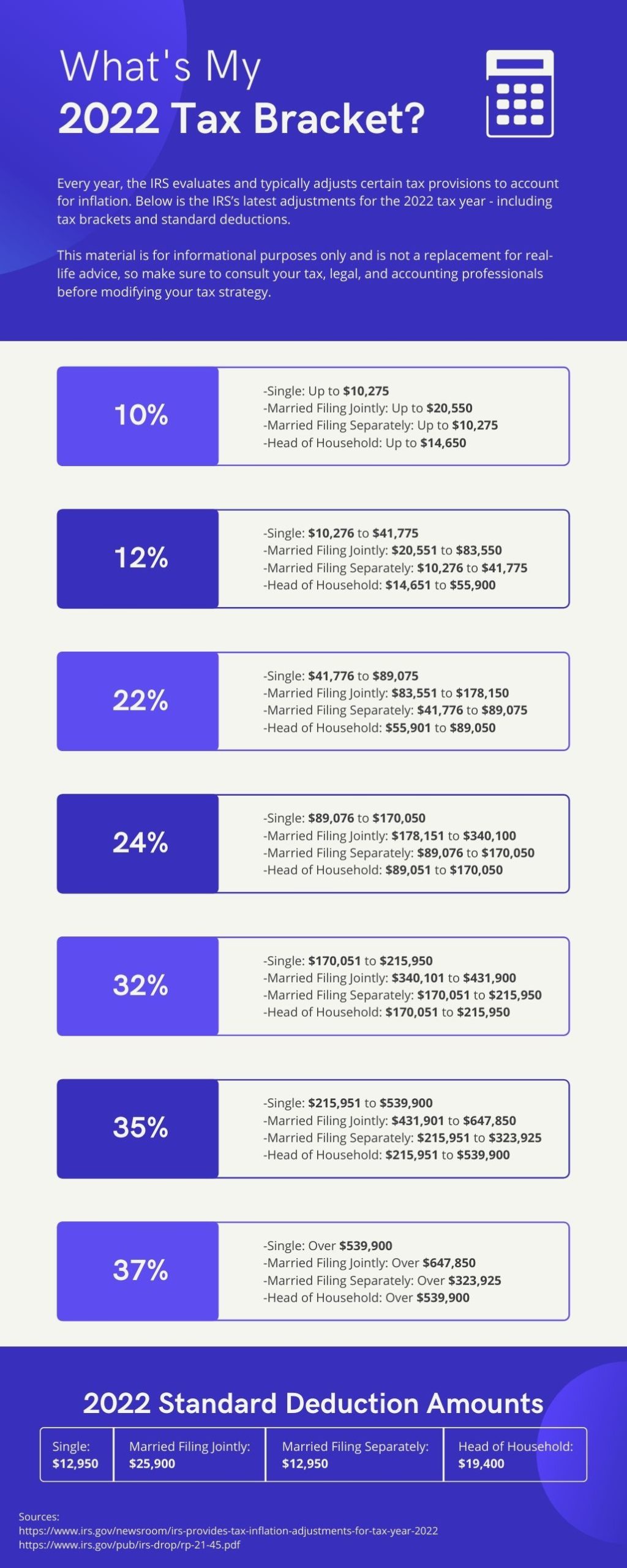

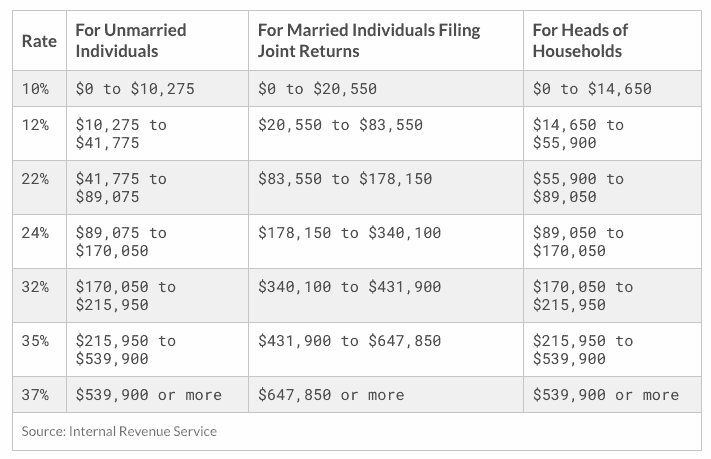

There are still seven tax rates in effect for the 2022 tax year. 10 12 22 24 32 35 and 37. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for.

9615 plus 22 of. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24. Over 83550 but not over 178150.

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. Below are the new brackets for both individuals and married coupled filing a joint return. 1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71.

Read on to see whats in store for 2023. 10 announced new tax brackets for the 2022 tax year for taxes youll file in April 2023 or October 2023 if you file an extension. 2055 plus 12 of the excess over 20550.

There are seven tax rates in 2022. Taxable income up to 10275. 1 day agoThe 2023 changes generally apply to tax returns filed in 2024 the IRS said.

1 day agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. 22 hours ago2022 tax brackets for individuals. Trending News Abbott recalls more baby.

Each of the tax brackets income ranges jumped about 7 from last years numbers. Download the free 2022 tax bracket pdf. 3 hours agoFor the 2022 tax year youll only be taxed 10 of your income up to a maximum of 10275 after.

Taxable income between 10275 to 41775. 2022 Tax Bracket and Tax Rates. You can see all the.

There are seven tax brackets. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you. Tax on this income.

20 hours agoTax brackets can change from year to year. The IRS on Nov. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing.

When it comes to federal income tax rates and brackets the tax rates themselves didnt change from 2021 to 2022. Taxable income between 41775 to 89075. 10 of taxable income.

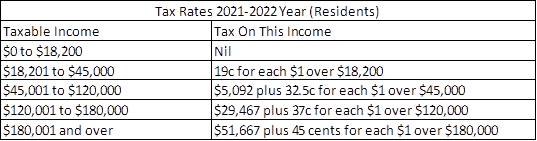

Resident tax rates 202223. The 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022. Over 20550 but not over 83550.

Federal Income Tax Rate 2022 - 2023. 2022 tax brackets are here. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

New Income Tax Table 2022 In The Philippines

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

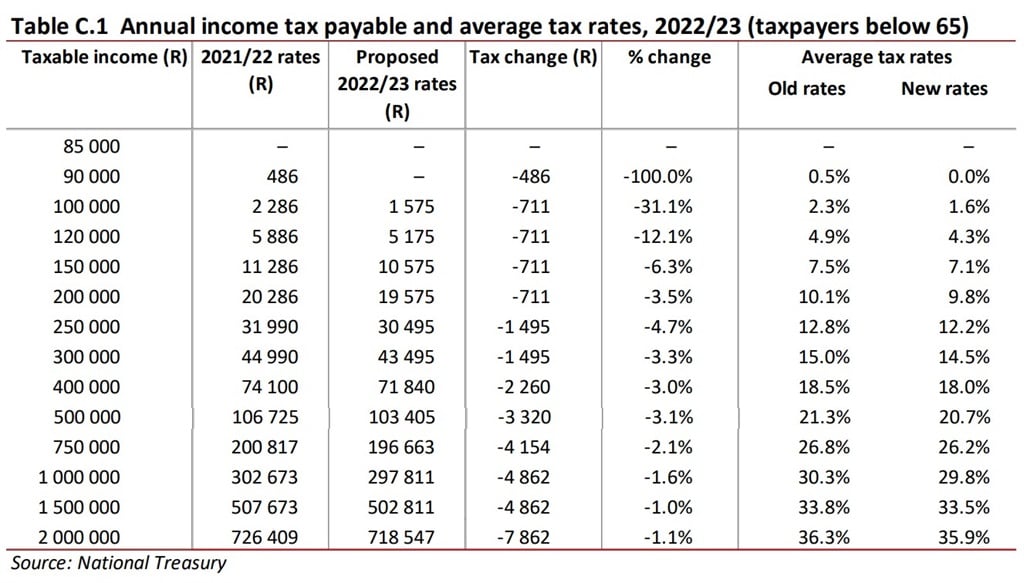

How Much You Will Be Taxed In South Africa In 2022 Based On What You Earn

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Everything You Need To Know About Tax In Australia Down Under Centre

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

Ways To Minimize Taxes In Retirement Wiser Wealth Management

Budget 2022 Tax Relief These Are All The Big Changes Fin24

Taxtips Ca Canada S 2021 2022 Federal Personal Income Tax Rates

Indonesia Income Tax Rates For 2022 Activpayroll

2022 Tax Inflation Adjustments Released By Irs

What S My 2022 Tax Bracket Infographic Delphi Advisers Llc

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

Jbg Accounting Consultancy New Tax Table 2018 2022 Facebook

Federal Income Tax Brackets For 2022 And 2023 The College Investor